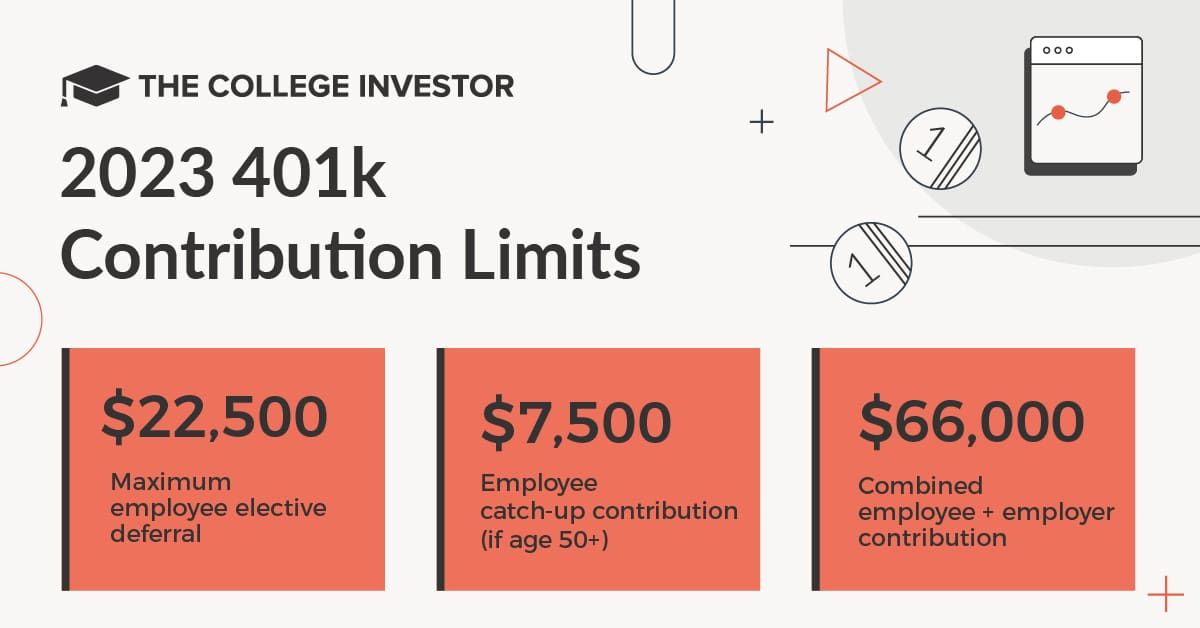

401k 2025 Catch-Up Contribution Limit Irs - 401k 2025 Contribution Limit IRS What You Need to Know, Plan participants in these plans may wish to consider the impact of the dollar. Ira contribution limits are increasing from $6,500 to $7,000. 401 (k) contribution limits are increasing from $22,500 to $23,000 in 2025, and from $30,000 to $30,500 for those age 50 or older.

401k 2025 Contribution Limit IRS What You Need to Know, Plan participants in these plans may wish to consider the impact of the dollar. Ira contribution limits are increasing from $6,500 to $7,000.

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. The irs has increased the contribution limit for 401k plans in 2025 to $22,500.

What Is The Ira Contribution Limit For 2025 a2025c, Employers are not allowed to contribute. 401 (k) contribution limits for 2025.

401k 2025 Catch-Up Contribution Limit Irs. The basic limit on elective deferrals is $23,000 in 2025, $22,500 in 2023, $20,500 in 2025, $19,500 in 2025 and 2025, and $19,000 in 2025, or 100% of the employee's compensation, whichever is less. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift.

401k Contribution Chart, For 2025, employees may contribute up to $23,000. 401 (k) contribution limits for 2025.

401(k) Contribution Limits in 2023 Meld Financial, This dollar amount is the same as in 2023. For individuals under 50, the standard 401 (k) contribution limit in 2025 23,000.

Significant HSA Contribution Limit Increase for 2025, This dollar amount is the same as in 2023. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, 401 (k) contribution limits for 2025. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

2025 Toyota Zephyr. Toyota makes no significant equipment changes to the 2025 toyota prius following […]

402k Contribution Limits 2025 Danny Orelle, The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. Employers are not allowed to contribute.

It means that including the $16,000 individual contribution limit, you’re able contribute $19,500 to a simple ira in 2025. 401 (k) contribution limits for 2025.